Udemy vs. Coursera: Rivals in Arms

A deep dive into factors that separate Udemy's and Coursera's Valuations

The stocks of both Udemy and Coursera — two edtech companies — have followed eerily similar trajectories since their public debuts in 2021 — each shedding over 75% of their market value.

Both companies have been around for over a decade. Udemy was launched in 2010, Coursera in 2012, and after years of refining their business models and growing their user base, they went public in 2021, just a few months apart. At their peaks that year, Coursera’s market cap hit roughly $7.5B, while Udemy’s grew to $4.5B. Fast forward to 2025—after four years in the public domain—their market caps are now just a stone’s throw apart, each hovering at a little above $1B. Once heralded as unicorns, it seems both companies are back to square one.

In my earlier post on Coursera, I valued the stock at $6.30 per share. And following my write-up, an upbeat Q1 earnings report later—the stock briefly rallied to $9/share before settling around $8.50, roughly 35% above my original intrinsic value estimate of $6.33. Does the revised guidance of narrower losses and increased revenue warrant an update to my valuation? Not really. Most of the growth expectations were already baked into the original estimate, and the business model remains unchanged: a company heavily reliant on high-cost content partnerships, with low retention and poor conversion from signups to paying customers, in a highly competitive, fragmented industry.

Coming back to Udemy, since the stock prices of both Coursera and Udemy have marched downward in tandem, I wanted to take a closer look at the company— understand if its stock decline is a reflection of its business fundamentals and risks, or is it simply another casualty of frayed investor confidence in the ed-tech space.

Business Model

Coursera and Udemy have very similar missions and business models: both offer expansive catalogs of educational content, with courses ranging from a few hours to several weeks and covering a broad spectrum of topics—from cloud computing to music and personal development. Both companies rely on subscription-based revenue models (though single-course purchases are still an option), and the revenue generated is split with instructors based on a predetermined formula.

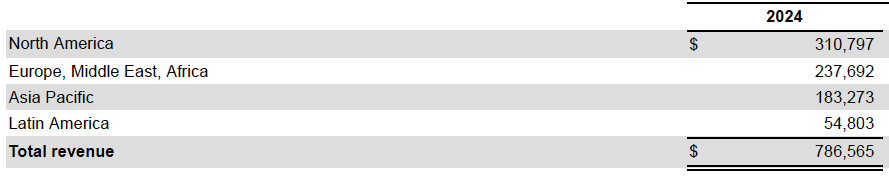

Each company boasts millions of learners, and their revenue streams are geographically diversified—with the bulk of revenue coming from outside the U.S.: 60% for Udemy and 53% for Coursera. And lately, both have jumped on the AI bandwagon—their annual reports mention “AI” dozens of times. (Not kidding—I counted 60 mentions in Coursera’s report.) As if those similarities weren’t enough, both companies also experienced top-level management churn this year, with each replacing its CEO.

For all their similarities, there are a few key differences that could potentially impact the reliability of their future cash flows, margins, and ultimately, their valuations.

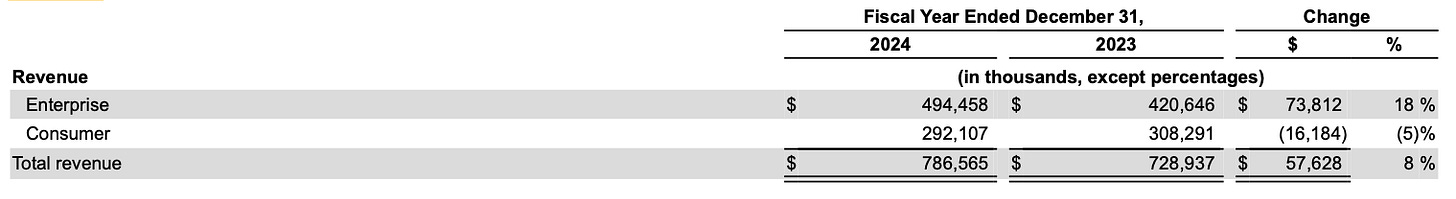

Business Focus: Udemy leans more heavily into the enterprise side of the business, generating around 63% of its revenue from that segment. Coursera, by contrast, is more of a direct-to-consumer brand, with only 34% of its revenue coming from the B2B segment. In terms of raw numbers, Udemy serves around 17,000 business customers—nearly 10 times Coursera’s count, which sits at roughly 1,600. A note of caution: it’s entirely possible these companies define “business customers” differently but I’m going by whats reported in their annual reports.

Course Catalog: Virtually anyone with a pulse and a recording device can create and host a course on Udemy. The platform acts as an intermediary—a marketplace where learners browse and enroll into courses. As a result, Udemy’s content library is significantly larger than Coursera’s: Udemy offers over 250,000 courses from more than 80,000 instructors, whereas Coursera’s catalog ranges from roughly 9,000 to 12,000.

Course Quality: Udemy’s user-generated content creation model leads to a large variance in course quality. It carries everything from well-structured thoughtfully designed courses such as this Python bootcamp to courses such as this one on LBO modeling where the instructor simply sits, all buggy-eyed and reads slides verbatim.

Coursera’s content, on the other hand, feels far more curated, since it’s created by university professors with a teaching pedigree or seasoned industry experts. Not saying all of it is good—but at least there seems to be some level of curation and vetting.

Key Valuation Drivers

Revenue Growth: From a valuation standpoint, Udemy’s product offering is bit of a mixed bag. The sheer size of Udemy’s course library means that if you want to learn a topic, it probably has something to offer. But on the downside its content quality is patchy. As Udemy pivots from single-course purchases toward subscription-based revenue, its low content quality could be problematic.

The company has struggled to scale its consumer business. In 2024, Udemy’s Enterprise segment grew by 18%, while the Consumer segment shrank by 5%. In addition, Udemy also relies heavily on discounting to drive purchases—think Bed, Bath & Beyond level of coupons. It’s not uncommon to see courses marked down 80% to 90%. That may help with volume, but it does little to build long-term pricing power or a premium brand perception.

Future Cash Flows:Udemy’s shift towards scaling its Enterprise segment looks like a more promising path. Business customers tend to be more reliable—they have bigger budgets, are less price-sensitive, and view employee training as a strategic benefit. They also churn less than individual learners. As a result, Udemy’s Enterprise segment offers more predictable and durable source of future cash flows.

Margins: Cost of revenue for both Udemy and Coursera is largely driven by payments made to content creators. Coursera shares about 50% of its revenue with partners, while Udemy parts with a little more than a third. But Udemy appears to have much more negotiating leverage. It’s already announced plans to reduce instructor payouts from a historical average of 25% to 15% by 2026. Could the content quality drop even further? I wouldn’t be surprised if we start seeing AI voices reading slides word-for-word. Margin expansion might look good on paper—but as a learner, it’s disheartening.

Coursera, by contrast, doesn’t seem to have that kind of pricing power. The balance of leverage lies with its high-profile university and corporate partners. In 2023, one of its largest partners (likely Google, though not named) renegotiated its agreement, causing Coursera’s gross margin to fall from 63% to 52%. That margin compression shaved roughly $100 million off its bottom line. Ouch.

Crunching the Valuation

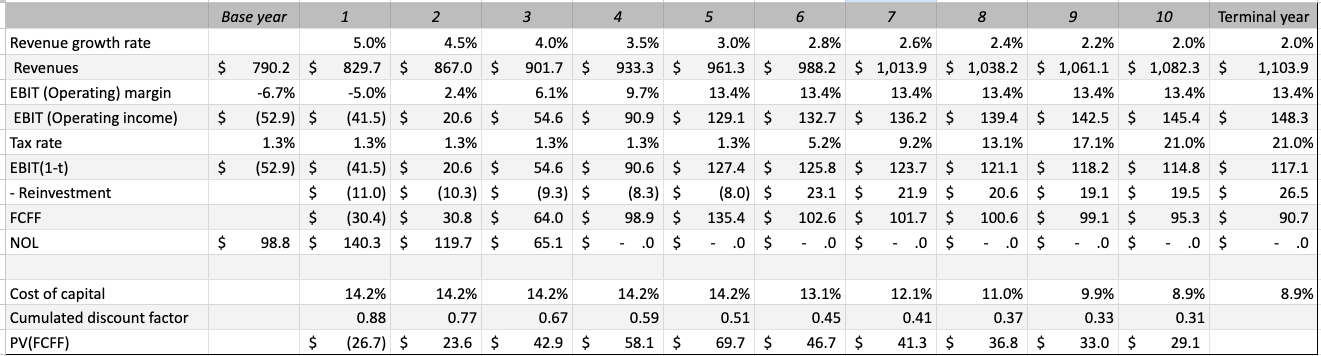

Revenue Growth: Udemy projects the global online education market will reach $435 billion by 2029, growing at a 15% CAGR. But while the industry accelerates, Udemy’s own growth has been modest—just 5.5% YoY. I’m assuming this sluggish trajectory will persist due to increased competition and instructor attrition due to a lowering of royalties. Over the next five years I’m projecting revenue to grow in the 3–5% range , gradually tapering to a 2% rate in perpetuity.

Margins:Udemy’s current operating margin is negative (–6.7%). Over time, I am assuming that margins will improve and converge toward 13.43%, the global education industry average. This margin expansion is supported by several strategic shifts the company has made in recent months: reducing instructor payouts from 25% to 15% by 2026, focusing on the higher-margin Enterprise segment, and leaning into subscription-based offerings, which tend to have better retention and higher LTVs.

Reinvestment: To estimate future reinvestment, I assume Udemy’s Sales-to-Capital Ratio will improve from its current –3.38 to a positive 1.11 as the business matures and capital efficiency improves..

Cost of Capital: With no interest-bearing long-term debt, I’ve set Udemy’s cost of capital equal to its cost of equity. Using CAPM:

Risk-free rate (Rf): 4.35%

Beta (β): 1.82 (from Yahoo finance)

Equity Risk Premium (ERP): 5.42%, adjusted for its global revenue mix

Cost of Equity = 4.35% + (1.82 × 5.42%) = 14.21%

Share Count: Udemy has 147.7 million basic shares outstanding. It also has 14.9 million RSUs, most of which I assume will vest, and 673,000 PSUs, of which I conservatively assume half will vest based on historical trends. This brings the fully diluted share count (excluding stock options) to approximately 162.9 million. The 1.35 million outstanding stock options have been valued separately using the Black-Scholes model at roughly $5.8 million.

Wrapping up : Discounting Udemy’s projected cash flows over the next 10 years and its terminal value yields an estimated value of operating assets of roughly $689M. Adding back the company’s cash reserves of $357M and subtracting the value of its options (~ $5.8M) results in a total equity value of $1.1B. Dividing total equity by the fully diluted share count of 162.97 yields an intrinsic value of about $6.81 per share.

With the stock trading at $7.29, it looks to be trading slightly above its fair value.

Factoring in Uncertainty

To account for uncertainty in my valuation, I ran a Monte Carlo simulation with 10,000 trials, varying two key inputs:

Long-term margins: Modeled as a log-normal distribution with a mean of 13.43%, a standard deviation of 1.34%, and a location parameter of 11%.

Growth rate in perpetuity: Assumed to follow a uniform distribution ranging between 1.5% and 3.5%.

Based on the results, there’s only about a 10% chance the stock is worth more than $7.50 per share. So while there’s some room for upside, most scenarios cluster well below that level

Bottom Line

Relative to their intrinsic values, both Udemy and Coursera appear to be overvalued. Coursera, with a current stock price hovering around $9, is trading at a significant premium—roughly 40% above my estimated fair value of $6.30. Udemy, by contrast, looks more accurately priced by the market: its current share price is about $7.31, only 7% higher than the intrinsic value of $6.81.

From a pure valuation standpoint, neither stock presents a compelling buying opportunity today. Coursera’s overvaluation seems tied more to its brand equity and academic partnerships than to its underlying financial performance or margin profile. It’s consumer flywheel narrative is attractive in theory, but the economics behind it—especially when viewed through the lens of marketing spend and conversion rates—don’t yet support the valuation.

Udemy, while still overvalued, looks more promising. Its margins are better, its cost structure more flexible, and its transition toward enterprise clients and subscription-based revenue gives it a clearer path towards operating profitability. It also seems to be actively addressing margin improvement through lower instructor payouts and a stronger B2B push.

If I had to choose between the two, I’d go with Udemy since it has a better shot at growing into its valuation. Still, as things stand, I’d stay on the sidelines until prices offer a more meaningful margin of safety.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Please conduct your own research or consult a financial advisor before making any investment decisions.