Valuing Coursera: We don't need no profits

A look at Coursera’s business model, margins, and why scale doesn’t equate to success.

They came with the promise of disruption and democratization , they saw, and…… well, they largely fizzled. As publicly traded companies, edtech firms have consistently underperformed the broader market, rarely turning a profit or giving investors much to cheer about.

Although distance learning has been around for decades, the new wave of edtech companies germinated from the MOOC movement in the early 2010s. MOOCs - massive open online courses — were built on the idea of open access (anyone with an internet connection could enroll), flexible pacing, and instruction from top-tier institutions or industry experts. The sheer scale of these early learning communities attracted plenty of attention — and funding — from the VC world. The next five years saw a rush of new players: Coursera, Udemy, Udacity, 2U, and edX, among others. The New York Times even branded 2012 as “The Year of the MOOC.”

Of those five, Coursera, Udemy, and 2U eventually went public. Udacity was absorbed by Accenture, and edX was acquired by 2U — a deal that later contributed to 2U’s downfall, as the company filed for bankruptcy under the crushing weight of the debt it took on to fund the acquisition. As public companies, Coursera and Udemy have met similar fates, with their stock prices marching downward in near lockstep. Since going public, Coursera has lost over 80% of its value, while Udemy is down more than 70%. During that same period, the broader market index has gained more than 34%.

In this post, I’ll take a closer look at Coursera — one of the high-profile survivors of the MOOC era — to assess whether the market’s judgment is justified. With its stock down more than 80% since its IPO, investors seem to have lost faith in the edtech story. But is Coursera simply a casualty of fading hype, or is there still a solid business underneath the wreckage? I’ll dive into the company’s fundamentals, business model, and growth prospects to see if the current valuation tells the full story.

The Business Model

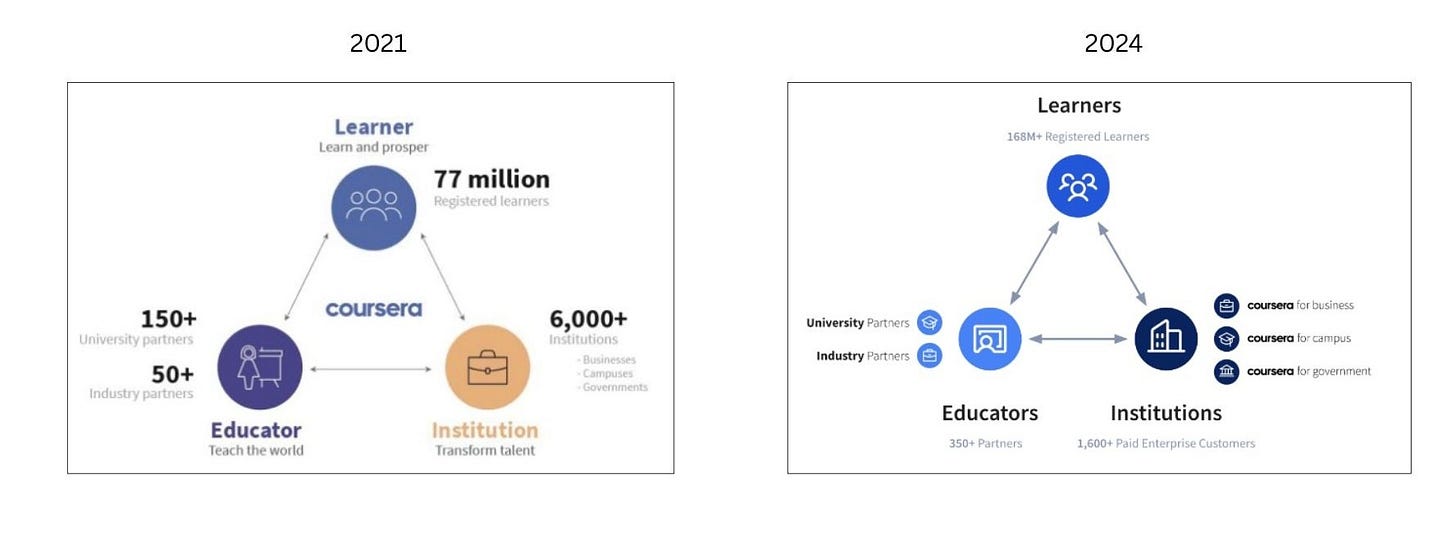

In its 2021 S-1 filing, Coursera laid out its pitch to investors: the traditional classroom-based learning model is outmoded - too rigid, too expensive, and too disconnected from the skills employers actually seeking. Its solution? Partner with elite universities and tech giants to bring education online. Backed by over 350 institutions, Coursera now offers more than 11,000 courses across a wide range disciplines, from AI to music and philosophy. Its roster of partners includes academic heavyweights like Wharton, Duke, and Johns Hopkins, alongside corporate giants such as Google, Meta, Microsoft, and IBM. Its educational offerings come in several formats - ranging from guided projects that take just a few hours, to short courses spanning a few weeks, to specializations and certificates that run for several months, and full bachelor’s or master’s degrees that can take a few years to complete.

Revenue Generation: Coursera earns revenue through three core segments. The Consumer segment brings in subscription revenue from individual learners, typically priced at ~ $399 per year - though it’s frequently discounted by as much as 50%. . The Enterprise segment monetizes through seat-based licenses sold to businesses, governments, and campuses, with pricing that scales for larger clients. The Degrees segment generates revenue through partnerships with universities, earning a share of tuition from online bachelor’s and master’s programs that range in cost from $9,000 to $50,000, depending on the institution and degree type.

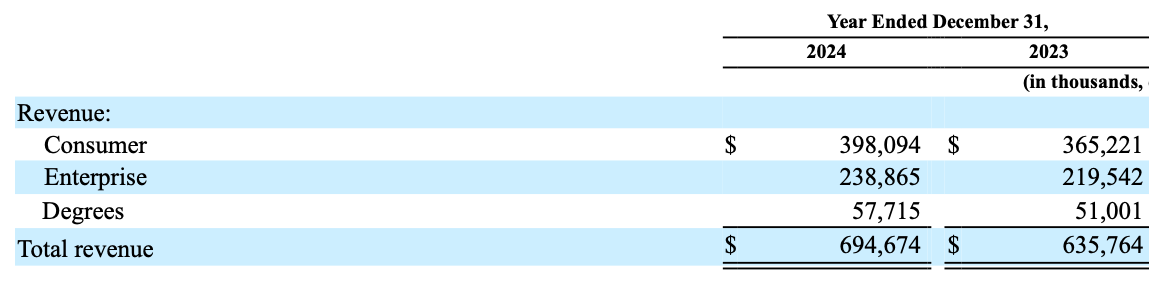

In 2024, nearly 60% of Coursera’s total revenue came from the Consumer segment, with Enterprise contributing about 35%, and the Degrees segment making up the remainder.

Gross Margins: While Coursera’s revenue is driven by subscriptions and licensing, its margins are shaped by content acquisition costs - namely, the revenue-share agreements it maintains with university and industry partners. Thankfully, Coursera in its 10K breaks down margins by each business segment painting a clearer picture of each part of the business contributes to the bottom line.

Coursera pays hefty licensing fees to its partners for content, which puts pressure on gross margins—especially in the Consumer segment, where gross margin sits around 54%. The Enterprise segment is more favorable, with gross margins of approximately 69%. The Degrees segment is structured differently: Coursera keeps its full share of the revenue, as its cut is taken as a service fee based on total tuition collected by university partners. However, company-wide gross margins are further reduced by costs not allocated to specific segments—such as platform support, depreciation, and amortization—bringing total gross margin down to roughly 53%.

And lastly, on a positive note, Coursera is geographically diversified, with approximately 46% of its revenue (~$326 million) coming from outside the United States. This global footprint not only broadens its addressable market but also reduces its dependence on any single region.

Operating Profitability

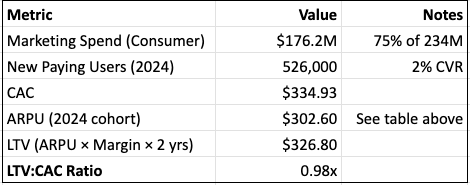

Aside from hefty licensing fees, Coursera spent nearly a third of its 2024 revenue -roughly $234 million - on marketing. That’s a surprising figure for a company that touts “efficient learner acquisition” . And so much for “ Our Consumer Flywheel creates a price-to-cost advantage”

CAC/LTV: Despite all the talk of efficiency, Coursera’s 170-page 10-K makes no mention of CAC, LTV, conversion rates, retention, or any of the typical metrics used to evaluate unit economics.

To get a clearer picture of Coursera’s acquisition efficiency, I’ll be working with a few core assumptions:

40% of 2024 Consumer revenue comes from the 2024 cohort, 30% from 2023, and so on.

Conversion rate from registrants to paying learners: ~2%.

75% of the marketing budget is allocated to the Consumer segment.

Customer lifespan: ~2 years.

Gross margin: 54% (as reported in the 10-K)

Cohort Breakdown — Revenue Contribution and Paying Users

CAC and LTV (Based Only on 2024 Cohort)

Based on the numbers above, the Consumer segment appears to be operating at or near breakeven or possibly at a slight loss. The Enterprise segment, on the other hand, could possibly be running much more efficiently — driven by higher gross margins (~69%), longer customer lifespans, and stronger retention. I estimate the Enterprise side of the business could be operating at an LTV/CAC ratio of around 4x. As for the Degrees segment, I’m setting it aside for now—its contribution to overall revenue remains relatively small.

Valuation

Now that we have the fundamental in place it’s time for some more number crunching and few more assumptions, Yay! :

Revenue Growth: I’m assuming revenue will grow at ~8.5% next year, gradually tapering down to the risk-free rate of 4.35% by Year 10. The global higher education market is projected to grow at a CAGR of 11.93% from 2025 to 2034, but given the fragmented and highly competitive nature of the industry, Coursera is likely to capture only a small piece of the pie. Based on my estimates, Coursera could generate ~$1.2 billion in revenue by 2034, representing a small share of the overall market despite steady top-line growth.

Margins: Coursera currently operates at an operating margin of -16%. I’m assuming this improves gradually, turning positive and reaching ~9.24% by Year 10, in line with the education sector average. Coursera has already taken steps toward improving its margin—in 2024, it undertook a restructuring exercise that reduced its workforce by 10%. And, encouragingly, its losses have declined each year since going public.

Reinvestment: To estimate reinvestment needs, I’m using the Sales-to-Capital ratio as a proxy. Coursera’s current sales to capital ratio is ratio is negative. Over time, I’m assuming this improves to 1.86 — the industry average — as the company matures.

Cost of Capital: Since Coursera has no interest-bearing long-term debt, I’ve equated its cost of capital with its cost of equity.

Risk-free rate (Rf): 4.35%

Unlevered beta (β): 1.36

Equity Risk Premium (ERP): 5.03%, adjusted for Coursera’s global revenue mix

Using the CAPM formula: Re = Rf + β * ERP = 4.35% + (1.36 * 5.03%) = 11.14%

In perpetuity, I’ve assumed that the cost of equity scales down to 8.4%, reflecting Coursera’s eventual stabilization as a mature business.

Share Count: Coursera has approximately 160 million shares outstanding, but that doesn’t tell the full story. The company also has RSUs, PSUs, and shares reserved for future grants - each of which carries the potential for dilution. For this analysis, I’ve included RSUs, excluded PSUs and future grants (perhaps unwisely), and valued outstanding stock options at ~$13 million using the Black-Scholes model. Altogether, the fully diluted share count comes to ~176.3 million.

Wrapping it all up: Discounting the terminal value and projected cash flows over the next 10 years yields an estimated value of operating assets of ~$400 million. Adding Coursera’s cash balance of ~$726 million and subtracting the estimated option liability of ~$13.67 million results in an equity value of approximately $1.12 billion. Dividing this by the fully diluted share count of ~176.3 million gives an intrinsic value of ~$6.30 per share. With the stock currently trading at $7.31, it appears to be trading at a modest premium to intrinsic value.

Factoring in Uncertainty

To account for uncertainty in the valuation, I ran a Monte Carlo simulation varying two key inputs in the model:

ROIC after Year 10: Modeled as a uniform distribution ranging from 8.5% to 15%

Target Operating Margin: Modeled as a normal distribution with a mean of 9.24% and standard deviation of 2%

After running 10,000 simulations, only 10% of the scenarios resulted in a share price above $8.10, while the mean estimated share price was $6.77. This suggests that the market is pricing Coursera fairly accurately, with the current share price sitting within the upper range of likely outcomes, but not wildly disconnected from its fundamentals.

Bottomline

Coursera has carved out a niche in the online learning space by offering high-quality content from top universities and industry partners. Its a well-diffreciated product but as a business, its destiny is closely tied to its content providers — partners who not only supply the learning material but also claim a significant share of its earnings.

With 168 million registered learners globally, Coursera has clearly made inroads into the education marketplace. Yet its original vision—converting those learners into paying customers cost-efficiently or upselling them into higher-priced degree programs—hasn’t quite materialized. By the end of 2024, the platform hosted just 26,700 degree students, each generating about $2,000 in revenue, or roughly $57 million in total. By contrast, a single institution like the University of California, Berkeley enrolls ~45,000 students, each paying an estimated $23,500 per year (a crude, back-of-the-envelope estimate, btw)— highlighting just how far Coursera has to go to reach meaningful scale on the degree front.

In some sense, Coursera is staying true to its mission of making education more accessible. But for investors who’ve put real money into the company, it’s less clear whether that trade-off has been worth it. Perhaps Coursera needs to rethink its path forward. To improve margins, it may need to rein in marketing costs, renegotiate content partnerships (if it has the leverage), prune its course catalog to eliminate overlapping content, and cut back on aggressive discounting and product promotions. It should even need to consider going private—shielded from the constant scrutiny of public markets.

With $700 million in cash, Coursera could be a compelling acquisition target. And with new leadership at the helm, that may be the most realistic path forward for investors hoping to see meaningful returns.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Please conduct your own research or consult a financial advisor before making any investment decisions.