I wanted to swim away from the tepid waters of ed-tech. After valuing Coursera, Udemy, and Duolingo, I’m turning my attention to an app I use almost daily but know surprisingly little about as a business: Yelp.

Yelp is best known for restaurant reviews, but the platform extends far beyond food. It hosts user-generated reviews for a wide range of local businesses — from dentists and lawyers to realtors, auto repair shops, and gyms. As a business, Yelp makes most of its money from advertising, which makes it more comparable to Google and Meta than to restaurant-focused platforms like DoorDash or Uber Eats.

Advertising is a lucrative business — high margins, low costs. Once you reach critical mass, with users on one side and eager advertisers on the other, it doesn’t just rain — it pours. That’s how Google and Meta have generated windfall profits and climbed to trillion-dollar valuations. Yelp operates a model similar to Google and Meta, but its $2B market cap puts it in a forgotten corner of the investment universe.

It hasn’t been a buzzy tech stock in years, and its glory days as a Wall Street darling are well behind it. It hasn’t flourished, but it hasn’t faded either.

Yelps slow drift shows up in the stock’s performance, too. If you had put $100 into Yelp at its IPO, you’d have about $140 today. That same investment in the S&P 500 would have more than quadrupled to roughly $435. The only thing Yelp’s stock can claim after ten-plus years is that it hasn’t collapse.

To understand why the stock has underperformed — and what might change that — it’s worth taking a closer look at how Yelp actually makes money.

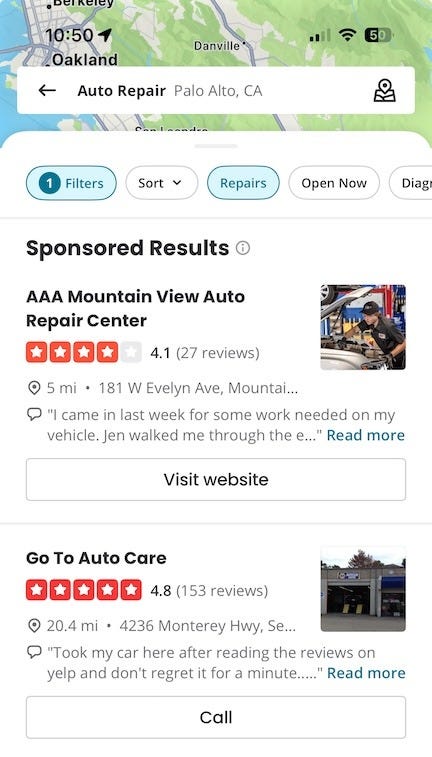

How Yelp Ads Work

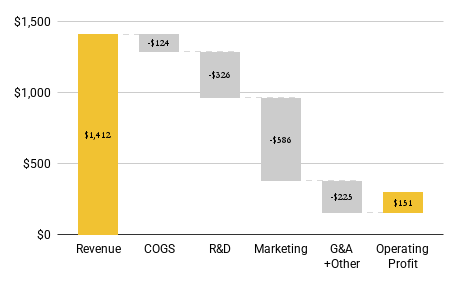

In 2024, Yelp generated over 95% of its $1.4B in revenue from advertising — a business model built entirely around selling ads and services to local businesses.

Yelp’s business runs on advertising, and like most digital platforms, it uses an auction-based system where advertisers bid for clicks. The mechanics are similar to Google’s: the highest bidder gets the top spot — the one most likely to be clicked — and pays Yelp their bid amount when someone clicks the ad.

This, of course, is a gross oversimplification of how these auctions actually work. Each platform has its own proprietary method for calculating what an advertiser ultimately pays using complex algorithms and multiple signals that go far beyond CPCs.

Although an auction for determining how much to pay might seem fair on the surface, that’s not how it plays out in reality. Ad platforms heavily influence pricing by setting auction floors — minimum bids just to enter the auction. On top of that, most platforms automate bidding “to help advertisers compete,” but when everyone uses it, bids spike, budgets drain, ROI sinks — and the platform walks away a little bit richer.

Business Model

Yelp breaks its business into two broad segments: advertising revenue, and subscription revenue from its various product offerings.

The Services category — which accounts for over 60% of revenue — includes home, local, auto, professional, pet, event, real estate, and financial services.

The Restaurants & Retail category contributes another 30–35%, and includes restaurants, shopping, beauty & fitness, and health-related businesses.

Yelp’s biggest expense is its massive sales force, tasked with the arduous job of convincing listed businesses to buy one of its many subscription products or advertising packages. About 67% of its 5,000 employees — roughly 3,400 — are in Sales and Marketing, effectively making Yelp a giant sales organization. The company spends over 40% of its revenue — nearly $600 million a year — on sales efforts alone.

As we build toward a valuation model, there are a few additional metrics that help shape the story:

Paying Businesses: Yelp’s customer base appears to have stagnated — and even appears to be shrinking. The company attributes this to macroeconomic pressures, but it could also be a sign of market saturation.

Unique Devices and Number of Reviews: The number of devices with the Yelp app has declined — down about 10% since 2022. That’s a bit concerning and might suggest Yelp’s popularity is fading. On the other hand, total reviews are still growing, up 7% year over year to roughly 308 million.

Ad Clicks: Yelp doesn’t disclose total ad clicks on its platform, likely for confidentiality reasons. However, it does report year-over-year trends. Interestingly, click volume has gone up despite a decline in both users and advertisers. One possible explanation is that Yelp is aggressively promoting itself on external platforms such as Meta.

CPCs: While ad inventory costs have remained flat, it’s reasonable to assume that advertising on Yelp is pricier than on broad-intent platforms like Google. Although the study is a bit dated, it found that advertising on Yelp was three times more expensive than on Google. Walled gardens such as LinkedIn and Yelp typically command higher CPCs because they serve more targeted, niche audiences.

The Valuation

Let’s get down to brass tacks now that we have a basic understanding of Yelp’s business model:

Revenues: Yelp’s business has matured, and the growth rate has already slowed to single digits. I’m projecting revenue to grow 5% next year, gradually declining to 2% over the next decade. This reflects a stagnating base of business customers and declining app engagement.

Margins: Over the past few years, Yelp has focused on improving its profitability. Operating margins have doubled from around 5% in 2022 to just over 10% in 2024. I’m assuming this trend will continue and top out at 18% by year 10. For comparison, operating margins at Google run around 32%, and Meta exceeds 40%.

Share Count: Yelp has 65M shares outstanding and an additional 6.5M in RSUs and PSUs. That brings the fully diluted share count to 71.75M. I’ve valued the outstanding options separately at around $29M.

Based on the present value of future cash flows and terminal value — adjusted for cash and outstanding options — I estimate Yelp’s equity to be worth $2.8B. Dividing that by the fully diluted share count of 71.75M yields an intrinsic value of about $38.77 per share. With the stock currently trading at $34.72, it’s priced at roughly a 10% discount to fair value.

To account for uncertainty, I varied one key input — long-term margins. More than 40% of the outcomes came in above today’s stock price of ~$34. If Yelp can continue expanding margins, there’s a strong case that the stock is undervalued.

Controversies Surrounding Yelp

I’d be remiss to end this valuation without acknowledging what makes Yelp such a tricky business to invest in. There’s more to the company than meets the eye.

The company has long faced criticism — and lawsuits — over aggressive sales tactics. Small business owners have accused Yelp of operating a pay-to-play system: advertise with us, or risk seeing your ratings mysteriously decline. For many local businesses, Yelp ratings are everything — and a drop can mean the difference between thriving and shutting down.

Yelp denies manipulating reviews, instead pointing to disgruntled business owners frustrated by negative feedback or confused by the platform’s review filtering system. To support its claim, Yelp notes in its annual report that 76% of submitted reviews pass through its filter. And to be fair, it has never been penalized by the courts.

But where there’s smoke, there’s fire — and in Yelp’s case, the sky is ashen gray. Online forums are filled with frustrated business owners, complaints about pushy sales reps, wasted ad budgets, and accusations of review tampering.

BottomLine

I’m conflicted about investing in Yelp. On one hand, the business looks undervalued — but on the other, it seems to be universally reviled by the very businesses it claims to support.

Its telling when South Park devotes an entire episode to mocking your business — and a Kickstarter-funded documentary — Billion Dollar Bully — is made to expose your practices. One of my favorite lines from the film is a business owner saying, “It’s like Yelp started the fire and is now selling the water to put it out.”

Would I invest in Yelp? The numbers say yes — but my heart says maybe not. I’ll keep watching and thinking it over.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Please conduct your own research or consult a financial advisor before making any investment decisions.